- The session on financing for the State Crusade for the development of industrial parks was recently held.

- Industrial Park developers, BBVA, Santander, Scotiabank, Bansí, AMAFORE, AMEXCAP, Bancomext – NAFIN, and FIRA gathered together.

- The new Spec-To-Suit construction model requires a change in the dynamics of obtaining financial resources from banks for the development of industrial parks and the search for other guarantee options.

- An invitation will soon be extended to all industrial parks in Jalisco to participate in collaboration with different financial institutions in order to standardize the financial solutions, as well as establishing unique options for every industrial park.

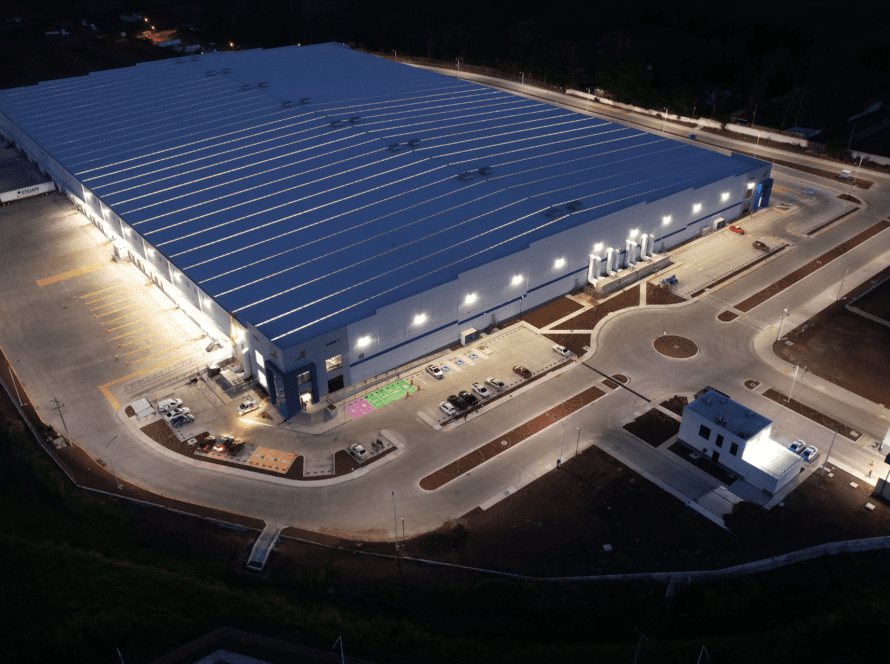

Guadalajara, Jalisco. A key issue for the development of new industrial parks is the financing of their construction, which is why in recent days the second session of the State Crusade for the development of industrial parks was held with a focus on financing.

The objective of this session was to bring together, through the Industrial Park Association of Jalisco (APIEJ) and the Secretary of Economic Development (SEDECO) of Jalisco, industrial parks, commercial banks, development banks, and capital associations to initiate a dialogue on the current financial challenges faced by industrial parks, as well as the presentation of the different services for the financing of industrial infrastructure that developers can access.

Guest speakers included representatives from the Mexican Association of Retirement Fund Administrators (AMAFORE), the Mexican Private Equity Association (AMEXCAP), Bancomext – NAFIN, Instituted Trusts in Relation to Agriculture (FIRA), BBVA, Santander, Scotiabank and Bansí.

At the beginning of the session, the APIEJ presented the Build-To-Suit construction model, the traditional construction model in which a lease contract is signed prior to starting the construction of the industrial building, so that the institutions that finance this type of projects assume less risk. However, currently the predominant construction model in the market is known as Spec-To-suit, a model that speeds up the construction, improvements, and delivery times of the industrial buildings needed to meet the significant increase in demand derived from nearshoring and the current global context; In the words of Bruno Martinez, President of APIEJ and CEO of Kampus Desarrollos, demand went from an average ticket in the year 2000 of 3,500 to 5,000 square meters and in 2010 from 7,500 to 10,000 square meters, to currently contemplate an average ticket greater than 15,000 square meters.

In this Spec-To-Suit model, developers have faced difficulties in accessing financing, since institutions see a higher risk of granting debt if there is no lease agreement in place. This is why the developers’ guild is calling for a change in the pattern of obtaining financial resources for the development of industrial parks in Jalisco, through collaboration with the main financial institutions in the country, as well as the search for guarantees so that during the months of uncertainty in which there is no signed tenant, the risks perceived by these financial institutions are minimized.

One of the proposals that will be submitted for analysis is that banks should ask developers for 12 to 13 months of debt service reserves and that those developers that have the backing of international funds should be willing to provide corporate guarantees during the construction period. Among the agreements reached at this session, it was decided to launch an invitation to carry out an exercise with two or three industrial parks that are seeking financing in order to find both standardized solutions and tailor-made options for each specific case. In turn, APIEJ will seek to act as a facilitator for those parks that wish to apply to this call.